The Definitive Guide to Scj Cooper Realtors

Little Known Facts About Scj Cooper Realtors.

Table of ContentsThe smart Trick of Scj Cooper Realtors That Nobody is Talking AboutHow Scj Cooper Realtors can Save You Time, Stress, and Money.Getting My Scj Cooper Realtors To WorkScj Cooper Realtors Things To Know Before You Get ThisThe Single Strategy To Use For Scj Cooper Realtors

You may also have a hard time to find adequate occupants to fill that office building or retail facility you bought. This is when you acquire a residence for a lower cost, remodel it quickly as well as then market it for a rapid profit.You're not interested in monthly rental fees when flipping a house. Rather, you require to buy a home for the most affordable feasible price if you intend to make a good revenue when marketing. Once again, research study is essential. You desire to discover a home in an appealing area, one that attracts plenty of customers.

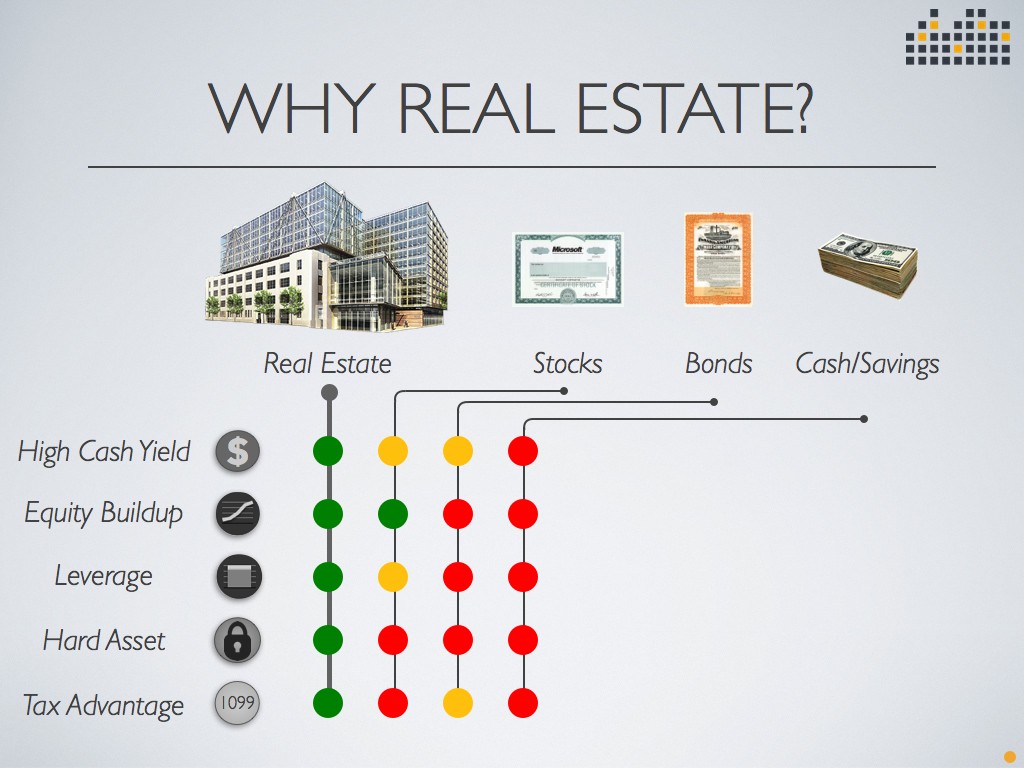

Diversifying your investment profile is important. If you put all your eggs in one basket, you might experience a complete loss in the blink of an eye. scj cooper realtors. Yet when you spend some funds in the stock exchange, other funds in bonds or ETFs, and some in realty, you raise your possibilities of greater earnings and fewer losses.

Neither is exact, as well as to guarantee you, here are 8 excellent reasons that realty is a good financial investment. The Leading Factors Property Is an Excellent Investment If you're assuming regarding purchasing realty, you will start one of the most effective financial investment journeys of your lifetime. scj cooper realtors.

The smart Trick of Scj Cooper Realtors That Nobody is Discussing

There aren't a lot of various other financial investments that allow you to buy assets worth far more than you have to spend. For example, if you have $10,000 to spend in the stock exchange, you can generally acquire just $10,000 well worth of stock. The exemption is if you spend for margin (obtain), however you have to be a recognized capitalist with a high internet well worth to make that take place.

Let's state you discovered a house for $100,000; if you place down $10,000, chances are you can locate a loan to finance the rest as long as you have good credit history and steady income. With that said, it suggests you spend just 10% of the asset's worth and also have it.

You will not get a dollar-for-dollar return on your financial investments, but some remodellings can pay you back as high as 80% 90% of the cash spent. The improvements don't have to be significant either. Naturally, adding an area or finishing the cellar will certainly add more worth than basic aesthetic remodellings, however also minor kitchen area and also bathroom renovations can significantly influence a residence's worth.

The Ultimate Guide To Scj Cooper Realtors

When you purchase stocks or bonds, you can just cross out any resources losses if you sell the possession for less than you spent for it. If you buy as well as hold actual estate, you can make regular monthly capital leasing it out, and this increases the profits from owning realty because you aren't counting only on the appreciation however the monthly rental earnings.

Roofstock Marketplace is a fantastic source. They not only checklist readily available financial investment houses up for sale, yet most of them have renters with leases in location currently. When you get the residence, you immediately end up being a property owner. Roofstock also provides a lot of due persistance, researching you, so all you have to do is acquire the residential property you believe is best.

There's not much to really feel secure concerning when you spend in the market. When you spend in real estate long-lasting, you understand you have an appreciating asset.

The Greatest Guide To Scj Cooper Realtors

Lots of people purchase actual estate to supplement their retirement income. Whether you own the building while you're retired, making the monthly rental capital to supplement your earnings, or you market a residential property you've possessed for several years once you're in retirement as well as make a profit, you'll increase your retirement income.

If getting property and also renting it out is click for more info too demanding for you, there are lots of various other ways to purchase property, including: Get an underestimated residential or commercial property, fix it up as well as turn it (solution as well as flip) Be a dealer working as the center guy between motivated sellers as well as a network click reference of purchasers.

Purchase a Genuine Estate Investment Company If you want to leave a heritage behind but don't believe going cash money is a great idea, passing property down can be even better. Not just will you give your beneficiaries an income-producing possession, however it's additionally an appreciating asset. They can either keep the property and allow the legacy proceed or sell it as well as gain profits.

For instance, let's say you have $50,000 equity in a residence. You can re-finance the mortgage on it, take out the $50,000, as well as utilize it as a deposit on your following building. Depending on the worth of your homes, you may even be able to pay money for future homes, enhancing your portfolio and the equity in it even quicker.

Some Known Incorrect Statements About Scj Cooper Realtors

While there's not a one-size-fits-all response, there are details qualities to look for when you spend in actual estate, including: Try to find an area that's attractive for occupants or with rapid valuing homes. Make find here certain the area has all the facilities and also eases most house owners desire Consider the area's crime rate, college rankings, as well as tax obligation background.